How can I see my spending habits in Beyond Finance Manager?

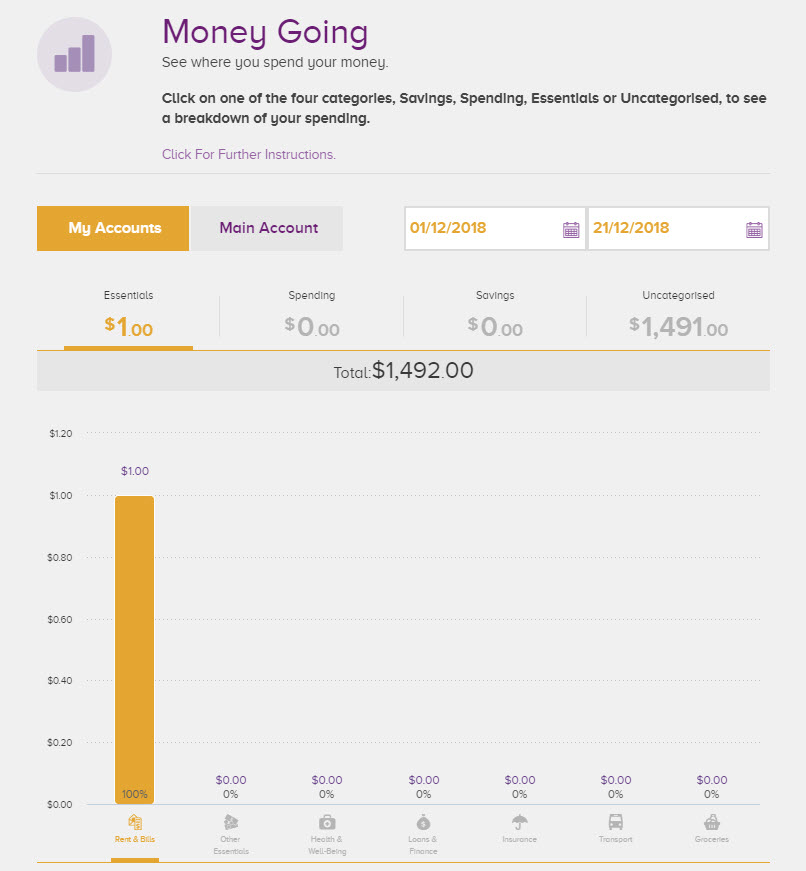

You can see your spending habits in Beyond Finance Manager. Money Going provides an overview of where you are spending your money by categorising your transactions.

Below we will look at how to use all of the functions on the page.

1. Click on the text 'Click for Further Instructions" to show more information about the page you are currently on.

2. Toggle between views for your main spending account and all of your Beyond Finance Manager accounts by clicking My Accounts or Main Account.

3. Choose the date range for the period in which you would like to view your transactions. The maximum date range is three months.

4. All of your groups, Savings, Spending, Essentials, and Uncategorised, are shown above the graph. Click the total figures for each group to see a graph that breaks down the transactions in that group into categories.

5. Each bar in the graph represents a category. To see a breakdown of that category, click the bar to see the transactions listed below.

https://www.beyondbank.com.au/need-help/how-can-i-see-my-spending-habits-in-beyond-finance-manager