What are goals on Beyond Finance Manager?

Goals allow you to set up a new savings account and dedicate it to reaching your dreams, by setting up recurring savings payments and showing your progress as you get closer to reaching the goal.

Creating a goal.

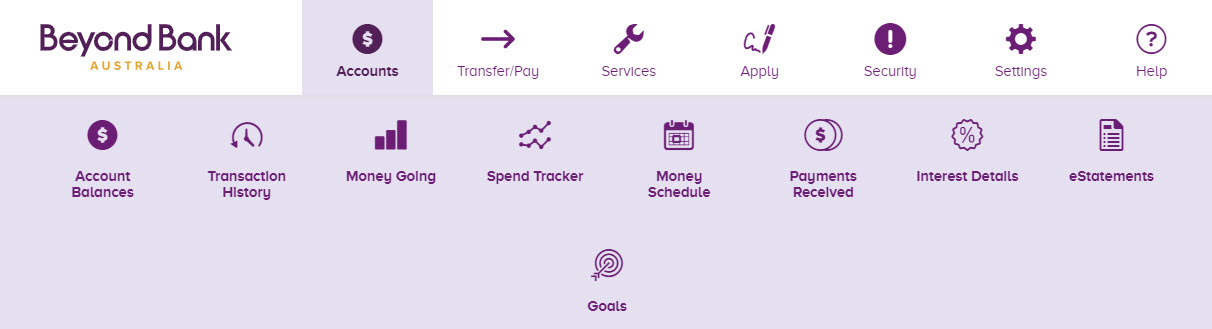

Clicking the Goals icon in the navigation bar at the top will take you to the Goals home screen.

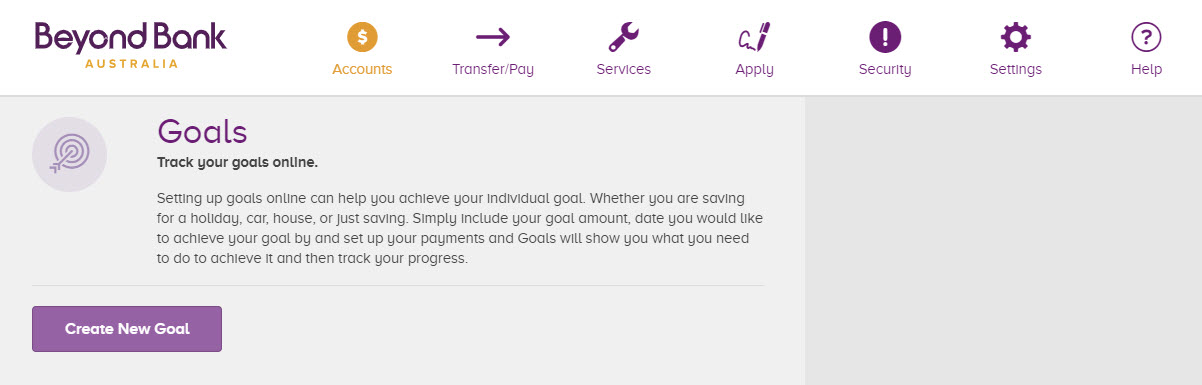

To get started, click Create New Goal. You will be presented with the screen overleaf.

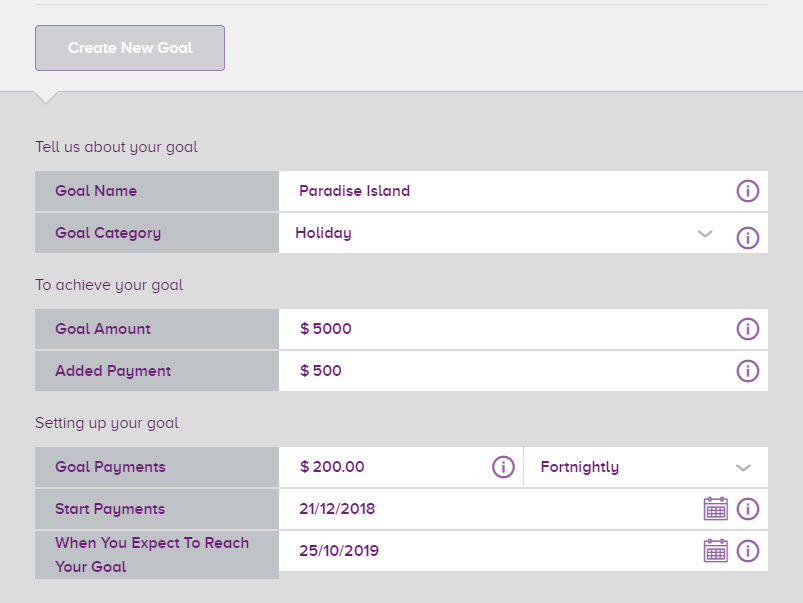

1. Enter the name that you would like for your goal. This name will display as the account name when you view the account under Account Balances.

2. Select a category for the goal. This will assign an icon, which will help if you have multiple goal accounts.

3. Enter the amount that you need to save to reach your goal. This can be any amount between $1-1 million.

4. The added payment field is for any payments that will be made to this goal that you do not need to save. For example, if you are saving for a car and already have a car that you plan to trade in, enter the amount that you expect to receive for the trade in. If you have some cash saved under your bed that you plan to spend on this goal, enter the amount that you have saved in this field.

5. Enter the amount that you would like your regular contribution to be.

6. Enter the frequency at which you would like to make regular repayments.

7. Enter the date that you would like to start making payments in the Start Payments field. This will automatically update the field below, depending on the amount, frequency of your regular repayments, and the date of the first one.

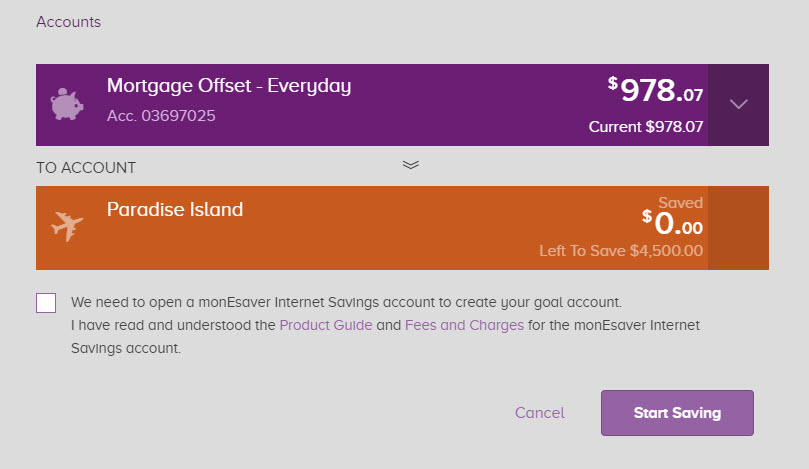

Further down the screen you will see the account selector and confirmation section:

1. Select the account that you would like the regular payments to come from.

2. This section is an indicator only. It is what the goal account will look like when it’s created.

3 Tick the box to when you have read the relevant details, then click Start Saving when you are happy with all of the details you have entered.

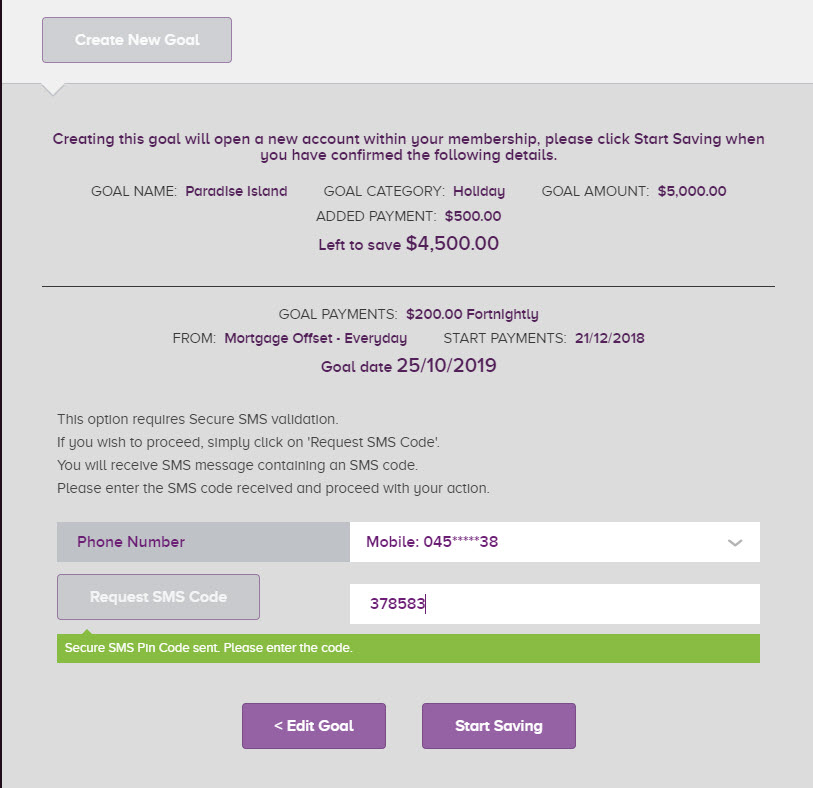

Clicking Start Saving will take you to the confirmation screen:

1. Click Edit Goal if you have noticed anything that needs to be changed. This will take you back to the Create a Goal screen.

2. Click Start Saving to confirm all of the details shown and create your goal.

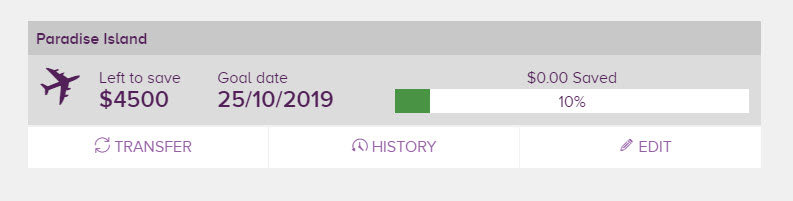

Once created, the goal will appear on the Goals overview page.

1. Left to save shows you how much more you need to reach your goal.

2. Goal date shows you the estimated date of achieving your goal, assuming that all regular payments are made.

3. The Saved bar shows you how much you have saved towards your goal.

4. This section houses the links to all of the sections related to your goal account. Transfer will take you to the Transfer screen, with your goal account selected the recipient account. History will take you to the Transaction History page for the corresponding goal account. Edit will take you to a screen where you can change any details of the goal account, or delete it.

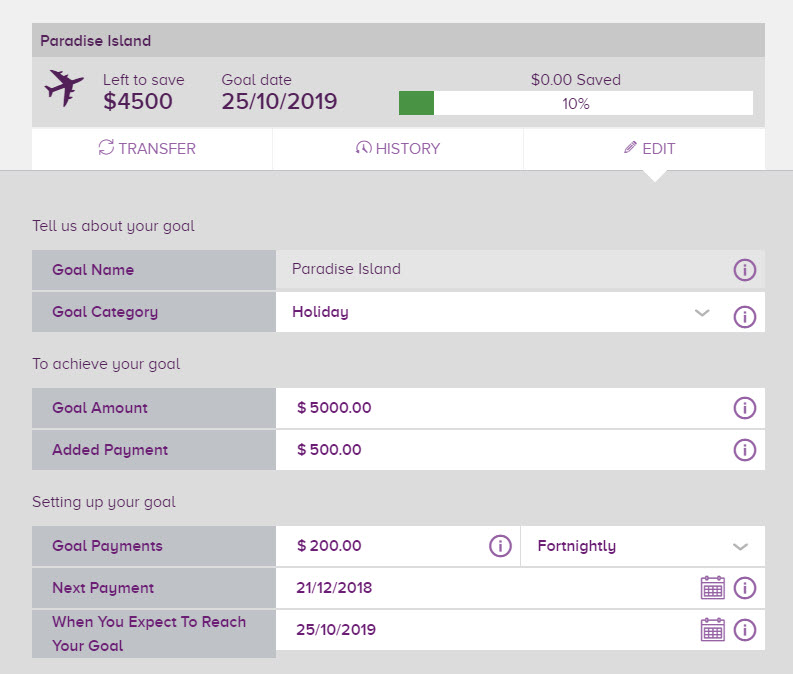

Clicking Edit on a goal listed on the Goals Overview screen will expand the goal and present you with a screen similar to the original Create Goal screen:

When you have created a goal, you will be able to see that goal on the Account Balances screen, which you are presented with when you log in to Internet Banking or can navigate to from the top navigation bar.

On the right side of the Account Balances screen you will also see new quick link to the Goals section. It will provide an overview of all of the goals that you have set up including your progress, and provide a link to navigate to the Goals overview page, where you can view and edit all of your goals.

This should be all you need to know to start saving for everything that you want. If you do have any questions you can call out Customer Relationship Centre on 13 25 85 Monday - Friday 8.00am - 8.00pm, Saturday 9.00 - 3.00pm ACST.

https://www.beyondbank.com.au/need-help/what-are-goals-on-beyond-finance-manager